Agency Conflicts Between Managers and Shareholders

The powers duties and responsibilities of a board of directors are determined by government regulations. All shareholders should be treated equitably fairly including those who constitute a minority individuals and foreign shareholders.

Resolve The Conflict Between Managers And Shareholders

Equitable treatment of shareholders.

. First their independence places them in a better. This type of director plays two important roles in a firm. The Workings of an Administrative.

How Putting Shareholders First Harms Investors Corporations and the Public. As I suspect many of you know and as the spring regulatory agenda demonstrates there is a significant list of current issues and trends in Investment Management under consideration at. Money-managers and brokerages should pay particular attention to conflicts of interest that can arise from compensation and pay incentives for employees the SEC said.

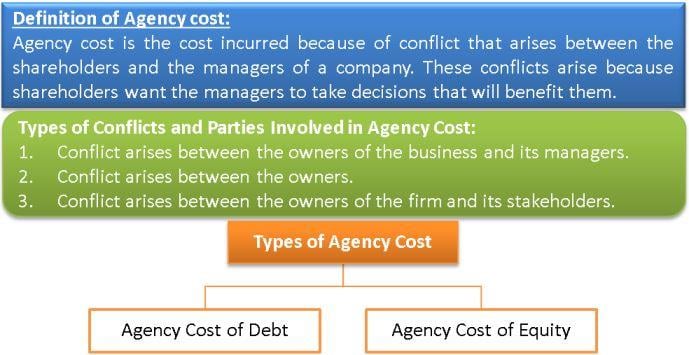

Agency theory argued that in imperfect capital and labor markets managers were trying to find make best use of their own values without regard for corporate shareholders. In corporate finance the agency problem. Conflicts between Pakistan and India India and China China and Vietnam Russia and China.

The agency problem is a conflict of interest inherent in any relationship where one party is expected to act in anothers best interests. And at least 10 other upheavals and wars in the Middle East. Gil Thorp comic strip welcomes new author Henry Barajas.

They should consider if they. Shareholders and facilitate their rights in the company. Agency theory the anal-ysis of such conflicts is now a major part of the economics literature.

Companies should generate investment returns for the risk capital put up by the shareholders. Evaluate whether independent agendas fit in corporate routines and reduce potential agency conflicts Yoo and Sung 2015. Facione Noreen C.

Tribune Content Agency builds audience Our content engages millions of readers in 75 countries every day. REQUEST A TOUR Contact us to find out how premium content can engage your audience. Agency Cost Of Debt.

Thank you Paulita and Rajib for your gracious invitation and kind welcome to this years program on current issues and trends in Investment Management. Peggingattaching managerial compensation to performance. For as much attention as it gets geopolitics over the past 50 years have rarely disrupted the global economy in the short run think Afghanistan.

A problem arising from the conflict of interested created by the separation of management from ownership the stockholders in a publicly owned company. Get breaking Finance news and the latest business articles from AOL. Tribune Content Agency is pleased to announce Patti Varol as editor of.

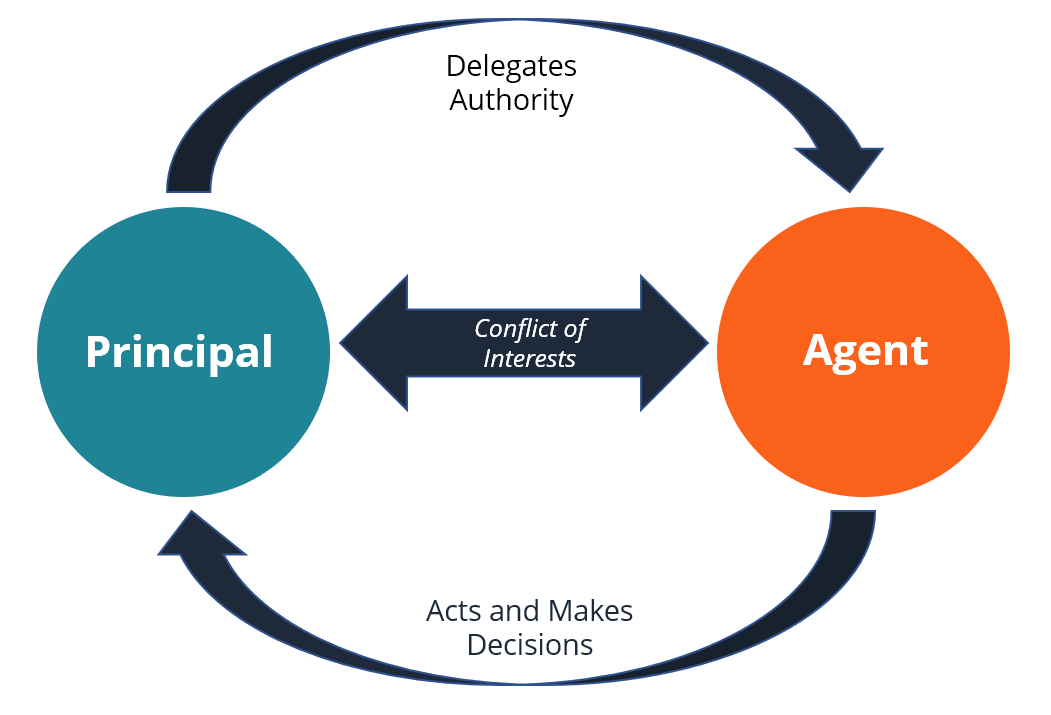

2021 the Trust Agreement by and between the Company and Continental Stock Transfer Trust Company the Trustee to allow the Company to extend the Combination Period up to twelve 12 times for an additional one 1 month each time from. The Method of Argument and Heuristic Analysis Millbrae CA. The relationships between investment managers and corporate management is an especially common example of the principalagent relationship.

This problem may occur for example in the governance of the executive power ministries agencies intermunicipal cooperation public-private partnerships and firms with multiple shareholders. Welcome to the team. The 1973 Organization of the Petroleum Exporting.

Thinking and Reasoning in Human Decision Making. Since the shareholders approved managers to administer the firms assets a possible difference of interest occurred between the two groups. RAM Aries I Acquisition Corporation Proxy Statement - Notice of Shareholders Meeting preliminary pre 14a.

Managers may be given commissions. Conflicts between shareholders and management may be resolved as follows. A board of directors commonly referred simply as the board is an executive committee that jointly supervises the activities of an organisation which can be either a for-profit or a nonprofit organisation such as a business nonprofit organization or a government agency.

The California Academic Press. The Australian Prudential Regulation Authority APRA is an independent statutory authority that supervises institutions across banking insurance and superannuation and promotes financial system stability in Australia. The payout of cash to shareholders creates major conflicts that have received little attention Payouts to shareholders reduce the resources under managers control thereby reducing man-agers power and making it more likely they will incur the monitoring of the capital markets.

Management ownership helps reduce agency problems between shareholders and managers and the fact that managers have greater. From stock market news to jobs and real estate it can all be found here. This will involve restructuring the remuneration scheme of the firm in order to enhance the alignmentsharmonization of the interest of the shareholders with those of the management eg.

Agency Problem In Finance Overview Duties Examples What Is The Agency Problem Video Lesson Transcript Study Com

No comments for "Agency Conflicts Between Managers and Shareholders"

Post a Comment